Chapter 13 MULTIPLE CHOICE - Which activity below is not performed by the HRM?

a) compensation b) training c) discharge d) recruitment and hiring In most companies the HRM/payroll cycle activities are accomplished by two separate systems. Which task below is typically not performed by an HRM system? a) training b) performance evaluation c) compensation d) recruiting and hiring of new employees What is

the payroll system's principal output?

a) hiring information b) checks to employees c) checks to government agencies d) internal and external use reports Which area provides information to the system about hiring, terminations, and pay rate changes? a) payroll b) timekeeping c) purchasing d) HRM Which of the following is not one of the major sources of input to the payroll system?

a) payroll changes b) time and attendance

data c) checks for insurance and benefits d) withholdings and deduction requests from employees - In the payroll system, checks are issued to

a) employees and to banks participating in direct deposit. b) a separate payroll bank account. c) government agencies. d) All of the above are correct. - Some companies have created a position called "director of intellectual assets." What is the objective of this position? a) measurement

and development of intellectual assets and human resources

CH 15 The Human ResourcesManagement and Payroll Cycleb) It should be kept indefinitely. c) It needs to be kept at least until the end of the current year. d) There is no rule about the retention of payroll records. Given the four activities below, which of the HRM/payroll cycle activities occurs infrequently relative to the others? a) updating of the payroll master file b) updating

information about tax rates and withholdings c) validating each employee's time and attendance data d) preparing payroll Time cards are generally used for employees who are paid on a(n)

a) monthly basis. b) overtime basis. c) hourly basis. d) production or piece-rate basis. For recording time spent on specific work projects, manufacturing companies usually use a a) job time ticket. b) time card. c) time clock. d) labor time card. Which category of employee below is least likely to use a time card or electronic time clock to track their hours? a) employees who manufacture a product b) accountants c) attorneys d) managers and professional staff Regarding the use of incentives, commissions and bonuses in payroll, which of the following statements is false? a) Using incentives, commissions, and bonuses requires linking the payroll system and the information systems of sales and other cycles in order to

collect the data used to calculate bonuses. b) Bonus/incentive schemes must be properly designed with realistic, attainable goals that can be objectively measured. c) Poorly designed incentive schemes can result in undesirable behavior. d) All of the above are true Many companies use incentives and bonuses to motivate greater productivity and better quality work. An effective bonus/incentive system should incorporate realistic,

attainable goals that can be

objectively measured. What is not a desired result of an employee bonus/incentive system? a) employees may recommend unnecessary services to customers in order to exceed set sales quotas and earn a bonus b) employees may look for ways to improve service c) employees may analyze their work environment and find ways to cut costs d) employees may work harder and may be more motivated to exceed target goals to earn a bonus Which of the following is most likely to be a daily

activity in the HRM/Payroll system? a) Approve payroll disbursement b) Prepare paychecks c) Sign payroll checks d) Update HRM/Payroll database A manufacturing company is likely to use __________ to collect employee time data for payroll and job time. a) badge readers b) supervisor's entries c) preprinted time cards d) retina scanning These are used to transmit time and attendance data directly to the payroll processing system. a) Badge readers b) Electronic time

clocks c) Magnetic cards d) None of the above Payroll deductions fall into the broad categories of __________ and __________.

a) payroll tax withholdings; voluntary deductions b) unemployment; social security taxes c) unemployment taxes; income taxes d) voluntary deductions; income taxes - Which of the following deductions is not classified as a voluntary deduction?

a) pension plan contributions b) social security withholdings c)

insurance premiums d) deductions for a charity organization Which type of payroll report contains information such as the employees' gross pay, payroll deductions, and net pay in a multicolumn format? One good way to eliminate paper paychecks is to

a) pay in cash only. b) pay with money orders. c) use the direct deposit method to transfer funds into employee bank accounts. d) use EFT. - What step can be taken to reduce

the distribution of fraudulent paychecks?

a) have internal audit investigate unclaimed paychecks b) allow department managers to investigate unclaimed paychecks c) immediately mark "void" across all unclaimed paychecks d) match up all paychecks with time cards This organization maintains the payroll master file for each of its clients and performs the payroll process. a) Cashier b) Payroll service bureau c) Professional employer organization

d) Virtual private network This organization provides payroll as well as other HRM services such as employee benefit design and administration. a) Cashier b) Payroll service bureau c) Professional employer organization d) Virtual private network Which of the following is not a benefit of using a payroll service bureau or a professional employer organization? a) Freeing up of computer resources b) Increased internal control c) Reduced costs d) Wider range of

benefits Many companies offer their employees a "cafeteria" approach to voluntary benefits in which employees can pick and choose the benefits they want. This approach is normally called a(n) a) elective plan. b) menu options benefit plan. c) flexible benefit plan. d) pay-as-you-go plan. The fourth step in the payroll cycle is preparing payroll. Pay rate information is needed in order to complete this task. The pay rate information is accessed by

the system from __________. a) the employees' personnel files b) the employee subsidiary ledger c) the payroll master file d) electronic time cards Part of the calculation necessary to process a payroll involves summing payroll deductions and subtracting the total from an employee's gross pay to arrive at net pay. Payroll deductions fall into two broad categories. Which deduction below would not be considered a voluntary deduction? a) disability insurance b) pension plan

contribution c) union dues d) social security taxes In a batch system, the payroll transaction file would contain

a) entries to add new hires. b) time card data. c) changes in tax rates. d) All of the above are correct. One step in the payroll cycle is the preparation of paychecks. In the next step the payroll register is sent to accounts payable for review. What is the following step in the process? a) The paychecks are distributed to the

employees. b) A disbursement voucher is prepared to authorize the transfer of funds from the company’s general account. c) The payroll taxes are computed. d) The earnings statements are printed. The document that lists each employee's gross pay, payroll deductions, and net pay in a multicolumn format is called a) an employee earnings statement. b) the payroll register. c) a deduction register. d) an employee time sheet summary. As the payroll system

processes each payroll transaction, the system should also perform which activity listed below? a) allocate labor costs to appropriate general ledger accounts b) use cumulative totals generated from a payroll to create a summary journal entry to be posted to the general ledger

a) hiring totally honest people to access and make changes to this file. b) segregating duties between the preparation of paychecks and their distribution. c) segregation of duties between the authorization

of changes and the physical handling of paychecks. d) having the controller closely review and then approve any changes to the master file. - Which of the following is not a potential effect of inaccurate time data?

a) increased labor expenses b) erroneous labor expense reports c) damaged employee morale d) inaccurate calculation of overhead costs Which control would be most appropriate to address the problem of inaccurate payroll

processing? a) encryption b) direct deposit c) cross-footing of the payroll register d) an imprest payroll checking account What is the purpose of a general ledger payroll clearing account?

a) to check the accuracy and completeness of payroll recording and its allocation to cost centers b) to make the bank reconciliation easier c) to make sure that all employees are paid correctly each week d) to prevent the cashier from having complete control of the payroll

cycle - A "zero balance check" refers to which of the following control procedures?

a) batch totals b) cross-footing the payroll register c) a payroll clearing account d) online edit control - Which of the following controls is inappropriate for payroll check writing?

a) restrict access to blank payroll checks and documents b) use of a payroll clearing account c) someone independent of the payroll process should

reconcile the payroll bank account d) sequential numbering of paychecks and accounting for the numbers - What is the best control to reduce the risk of losing payroll data?

a) passwords b) physical security controls c) backup and disaster recovery procedures d) encryption One threat to the HRM/payroll cycle is the potential for violation of employment laws. This threat relates directly to the process or activity of a) payroll

processing. b) general activities found in the cycle. c) hiring and recruiting. d) none of the above What is a potential threat to the activity of payroll processing?

a) hiring unqualified employees b) poor system performance c) violations of employment laws d) unauthorized changes to the payroll master file The results of an internal audit finds that there is a problem with inaccurate time data being entered into the payroll system. What

is an applicable control that can help prevent this event from occurring in the future? a) proper segregation of duties b) automation of data collection c) sound hiring procedures d) review of appropriate performance metrics Theft or fraudulent distribution of payroll checks is a potential threat to the payroll processing activity. What is one control that can be implemented to help prevent paychecks being issued to a "phantom" or "ghost"

employee? a) the cashier should sign all payroll checks b) prenumber all payroll checks c) use an imprest account to clear payroll checks d) paychecks should be physically distributed by someone who does not authorize or record payroll

SHORT ANSWERDefine an HRM/payroll cycle. What are the basic activities in an HRM/payroll cycle? List the various ways used to compensate employees. What are different types of deductions in

payroll? Why are accurate cumulative earnings records important? Explain the functions of the payroll register, deduction register, and earnings statement. What is a payroll service bureau?

22. B23. A24. B25. A26. B27. C28. D29. C30. B31. A32. C33. A34. B35. C36. B37. C38. C39. D

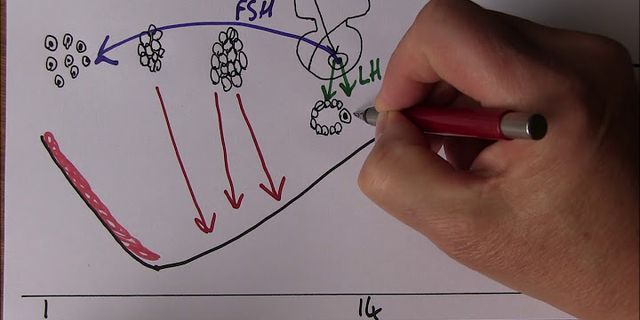

40. B41. B42. B43. C44. A45. C46. A47. B48. D49. C50. D51. C52. A53. C54. B55. C56. C57. D58. B59. DThe HRM/payroll cycle is a recurring set of business activities and related data processing operations associated with effectively managing the employee work force. Important activities in the

HRM/payroll cycle include the following tasks: Recruitment and hiring of new employees. Training. Job assignment. Compensation (payroll). Performance evaluation. Discharge. Hourly rate; Piece rate (based on some form of production activity); Fixed salary; Commission based on sales or some quantitative measure; Salary plus commission; Bonus incentives; stock options. Payroll deductions include: Payroll tax withholdings such as federal, state, and local income taxes

social security taxes, unemployment taxes; Voluntary deductions such as contributions to a pension plan, premium for group life, etc. Accurate records of cumulative earnings are necessary because social security and other deductions have maximum earnings amounts upon which taxes are paid; and the appropriate amount of income and payroll taxes should be remitted to the government agencies. The payroll register is a report that lists each employee's gross pay, payroll

deductions, and net pay for each pay period. The deduction register lists the voluntary deductions for each employee. The earnings statement lists the amount of gross pay, deductions, and net pay for the current period, as well as providing year-to-date totals. A payroll service bureau is a company that can be hired as an independent contractor to maintain the payroll master file and perform the payroll processing activities for an organization. A professional

employer organization is a company that provides not only full payroll services but also provides HRM services such as employee benefit design and administration. An HRM/payroll system relies on input from various sources. Employees provide input when they make changes in their discretionary deductions (contributions to charities or retirement plans); various departments provide data about the actual hours employees work. The HRM department provides information about employees who

have been hired or terminated, pay-rate changes, and promotions. Government agencies provide tax rates and various instructions for meeting regulatory requirements. Insurance companies and other organizations provide instructions for calculating and remitting various withholding amounts. Sales staffs are often paid either on a straight commission basis or a combination of a salary plus commissions. This is done to keep sales at a certain level or to increase sales. The HRM/payroll

system will need input from the sales and other cycles to properly calculate commissions and bonuses for such employees. It is important that an incentive and bonus system sets realistic, attainable goals that are congruent with corporate objectives. It is also important that managers monitor incentive and bonus goals and ensure that the attainment of such goals is appropriate for the organization and does not lead to undesirable behavior, which can result from poorly designed incentive

schemes. Direct deposit of paychecks provide a savings to employers because the costs of purchasing, processing, and distributing paper checks is eliminated. Using direct deposit also reduces postage and bank fees. The cashier's time can be better spent because paychecks do not have to be signed. Employees save time as well as they do not have to make a physical trip to the bank to cash their checks. Direct deposit is safer as it eliminates misplaced paychecks and reduces the

possibility of the theft of checks. Soft assets represent intangible employee skills and knowledge in the organization, whereas hard assets represent tangible assets like buildings, land, or machinery. Many established information technology companies like Microsoft

master file, should never be allowed to directly participate in actual payroll processing or paycheck distribution. This way an adequate control is created to match actual paychecks (or earnings

statements when direct deposit is in place) with employees when a manager, supervisor, or other third party hand out the checks (or earnings statements). Also, a different individual should approve all changes to the payroll master file in writing other than the individual who recommends or initiates the changes. User IDs and passwords should always be used to control access to the payroll master file, and an access control matrix should be established to define what actions each authorized

employee is allowed to make and confirms the files the employee may access. 74. Three types of controls can be used to circumvent payroll errors in an HRM/payroll system. Batch totals are used to verify totals entered into the system both at the time of data entry and at each stage in the processing. Hash totals are particularly useful in this regard, since hash totals calculated at the time of original data entry and again at each stage in the process can be compared. When the comparisons match

throughout the process, three conclusions can be made: 1) all payroll records have been processed; 2) the data input was accurate; and 3) no bogus time cards were entered at any point after initial input. Upon completion of a payroll, the payroll register should be cross-footed to verify that the totals of the net pay column and other deduction columns equal the total of the gross pay column. A third control is the use of a payroll clearing account. This is a general ledger account that can be

used as part of a two-step accuracy and completeness process. First, the payroll control account will be debited for the amount of the gross pay for the pay period; cash and other various withholding liability accounts are credited. Second, the cost accounting process distributes labor costs to various expense categories and credits the payroll control account for the total amount of the debits made to the other accounts. The result is that the payroll control account will have a zero balance.

This becomes an internal check known as a zero balance check, indicating that the proper postings have been made to all of the accounts associated with payroll for a given pay period.

What is the human resource cycle?

The HR lifecycle is a concept in human resources management that describes the stages of an employee's time with a given organization and the responsibilities of the human resources department at each stage. Each stage of the HR lifecycle presents its own challenges and opportunities.

What is human resource accounting system?

Human Resource Accounting (HRA) is the process of identifying and reporting investments made in the human resources of an organisation that are presently unaccounted for in the conventional accounting practice. It is an extension of standard accounting principles.

What are the four stages of the human resource cycle?

HR life cycle steps include business strategy, HR strategy, organizational design, job & team design, HR planning, vision & culture, recruitment & selection, onboarding & induction, assessment & appraisal, training & development, engagement & reward, career management and exit.

AIHR Learning Bite: How to Implement an HRIS in 6 Steps. The search phase.. The planning and aligning phase.. The defining and designing phase.. The configuring and testing phase.. The training and configuration phase.. The deployment and sustainability phase.. |